Credit Management Consulting

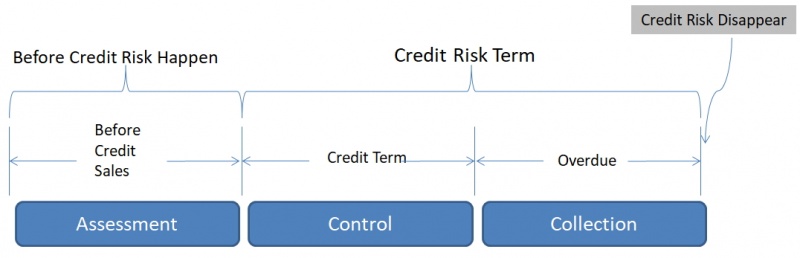

Credit risk is mainly from credit sales. Upon credit sales happen, risk is following up. Companies have to face the risk until it disappears: receivables are paid off or bad debt is taken loss.

Key-Finder provides solutions for all 3 Key phrases

of credit risk management:

Assessment starts before credit risk even occurs (i.e. credit term is not granted yet).

Risk control begins at the point of credit sales until credit term is over, i.e. the whole period of credit term.

Collection takes place right after credit term is over till risk disappears.

To serve each of these three phrases, we have developed solution of Whole-Process AR Outsourcing:

Our solution starts from credit assessment for your target customers such as credit analysis, credit evaluation and credit term proposal. And extend to payment and credit quality monitoring such as payment reminding, credit alert, past due collection as well as distressed debts purchase. Until we represent clients to legal action against the debtors and enforcement through our own law firm and network all over China.